At the Law Office of Kevin L. Hernandez our focus is representing consumers facing identity theft, illegal debt collection tactics, credit reporting errors, and debt lawsuits.

As a firm established by a native Nevadan, we are committed to protecting Nevada's consumers by restoring their credit and fighting back against harassing debt collectors.

We bring claims for consumers, often at no out-of-pocket cost, because federal consumer protection statutes provide for reimbursement of attorney's fees and costs if the claim is successful.

Identity TheftIncidents of identity theft, especially among elderly and veteran Americans, have been on the rise each year. If you are a victim of identity theft, our office will represent you to contact the appropriate authorities, bring claims against any companies collecting or reporting fraudulent debts, and ensure that your identity is restored, often for no out-of-pocket expense.

|

Illegal Credit ReportingThe FCRA protects consumers against inaccurate credit reporting by creditors and credit reporting agencies. If you are a victim of illegal or inaccurate credit reporting, our office can represent you often for no out-of-pocket expense.

|

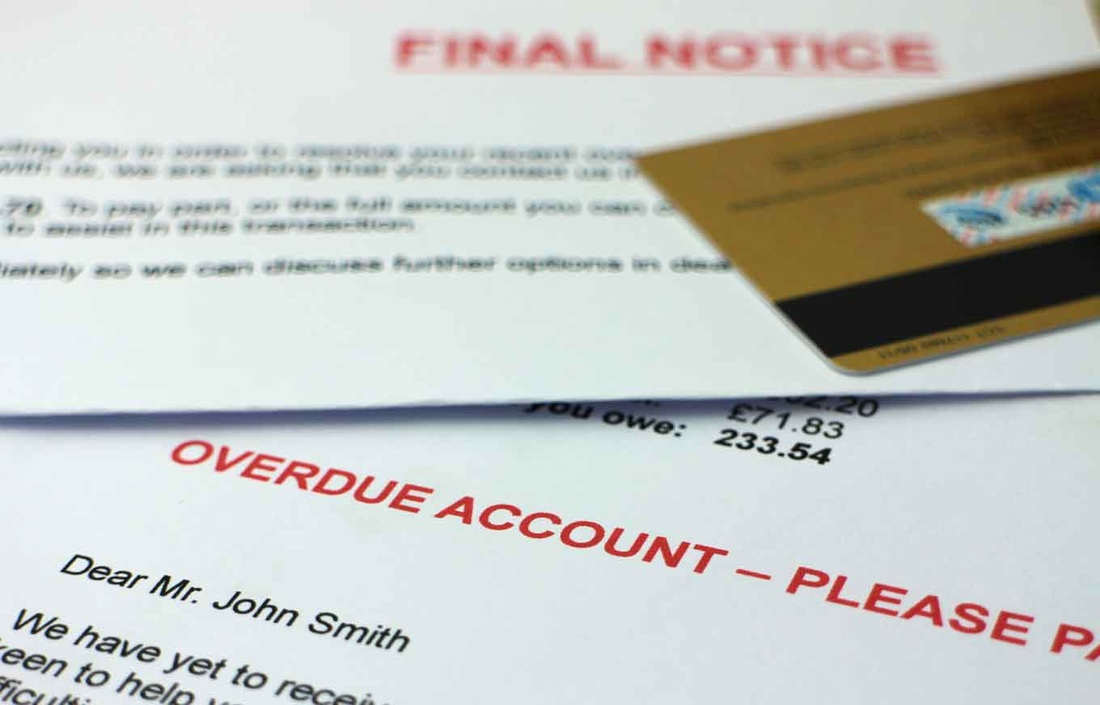

Illegal Debt Collections and Debt DefenseThe FDCPA prohibits unfair, deceptive, and illegal debt collection tactics initiated by third-party debt collectors to collect consumer debts. Examples of consumer debts include credit cards, medical bills, and student loans. Our firm protects consumers who are being harassed, abused, or deceived by debt collectors.

The firm also represents consumers facing debt lawsuits to ensure the debts are valid and the debt collector has the right to collect. If we determine the debt is valid and there are no available defenses, we fight to provide you the best outcome possible. |